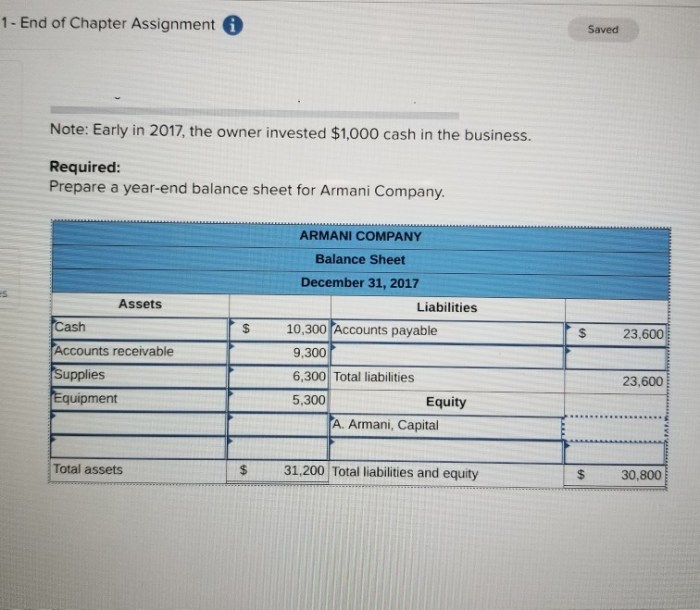

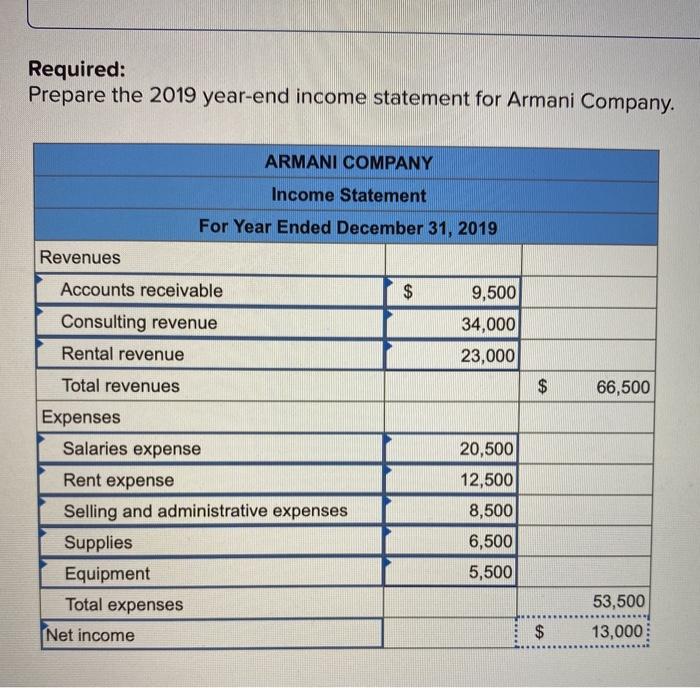

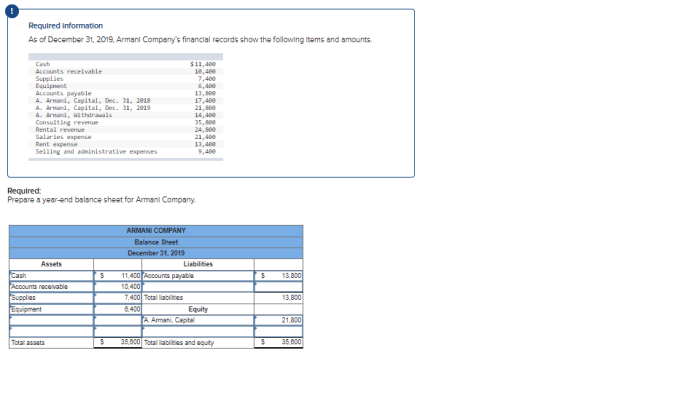

Prepare the current year end balance sheet for armani company – Preparing the current year-end balance sheet for Armani Company is a critical task that provides a comprehensive snapshot of the company’s financial health. This guide will delve into the intricacies of balance sheet preparation, covering essential concepts, valuation methods, and year-end adjustments to empower readers with the knowledge and skills to effectively execute this task.

Balance Sheet: A Comprehensive Guide

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and equity, which are essential elements for assessing the company’s financial health and performance.

Assets

Assets are resources owned by a company that have economic value and can be converted into cash or used to generate income. Assets are classified into two main categories: current assets and non-current assets.

- Current assetsare assets that can be easily converted into cash within one year, such as cash, accounts receivable, and inventory.

- Non-current assetsare assets that are not expected to be converted into cash within one year, such as property, plant, and equipment.

Assets are valued using various methods, depending on the nature of the asset. Common valuation methods include historical cost, fair value, and net realizable value.

Liabilities, Prepare the current year end balance sheet for armani company

Liabilities are obligations of a company that represent amounts owed to creditors or other parties. Liabilities are classified into two main categories: current liabilities and non-current liabilities.

- Current liabilitiesare obligations that are due within one year, such as accounts payable, short-term loans, and accrued expenses.

- Non-current liabilitiesare obligations that are not due within one year, such as long-term loans, bonds, and deferred income.

Liabilities are typically valued at their present value, which is the amount that would be required to settle the liability today.

Equity

Equity represents the ownership interest in a company. It is calculated as the difference between the company’s assets and liabilities. Equity is divided into several components:

- Retained earningsare the accumulated profits of a company that have not been distributed as dividends.

- Share capitalrepresents the par value of the company’s issued shares.

- Other equity accountsmay include items such as treasury stock, revaluation surplus, and foreign currency translation adjustments.

Equity transactions can include dividends, share repurchases, and stock issuances, which can impact the equity section of the balance sheet.

Questions Often Asked: Prepare The Current Year End Balance Sheet For Armani Company

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

What are the different types of assets?

Assets can be classified as current assets (convertible to cash within one year) or non-current assets (convertible to cash in more than one year).

How are liabilities classified?

Liabilities are classified as current liabilities (due within one year) or non-current liabilities (due in more than one year).